Compound interest formula calculator

Because in the simple interest the interest is not added while calculating the interest for the next period. C5 C7 C6 1000 10 0.

Expanding Compound Interest Equation To Find R Excel Formula Intrest Rate Compound Interest

The basic formula for Compound Interest is.

. Compound Interest Formula calculator. In essence this is a mathematical constant that can be expressed as a logarithm which means that there is an exponentiation property at play. Treasury savings bonds pay out interest each year based on their interest rate and current value.

Teaser raters on adjustable mortgages APR rates on credit cards which dont highlight other fees or the compounding effects and secured credit cards which have an effective APR of above 100 after paying for the membership fee - and whats worse is that on a secured credit. A 0 is the initial amount present value. Now lets say you deposited the same amount of money.

Compound interest is the interest added to the original amount invested and then you earn interest on the new amount which grows larger with each interest payment. Compounding is the effect where an investment earns interest not only on the principal component but also gives interest on interest. You can also use this formula to set up a compound interest calculator in Excel 1.

Interest principal rate term So using cell references we have. Compound interest is a method of earning interest on your invested money. You dont have to be a numbers wizard to understand the basic daily compound interest formula.

When calculating compound interest the number or the frequency of compounding periods will make a big difference or one can say a significant difference. The number of times your interest gets compounded per year 4. Compound interest calculator online.

The basic formula for compound interest is as follows. PV FV1r n. Compound It Compound Frequency Annually Semiannually Quarterly Monthly Daily.

Lets look at the factors within the compound interest formula. In maths compound interest is calculated based on the principal amount and the interest accumulated over the past periods. Calculate interest compounding annually for year one.

However those who want a deeper understanding of how the calculations work can refer to the formulas below. R is the nominal annual interest. It uses this same formula to solve for principal rate or time given the other known values.

The formula to calculate. Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. You can use the following Compound Interest Calculator.

To calculate compound interest use the formula below. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate compounded. The rate of interest your investor offers 3.

Our calculator provides a simple solution to address that difficulty. We are constantly shown numbers which are stripped of context. The FV function can calculate compound interest and return the future value of an investment.

A n is the amount after n years future value. The concept of compound interest is the interest adding back to the principal sum so that interest is earned during the next compounding period. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

For example you deposited 1000 on a bank at 3 for a year. To use the compound interest calculator youll need to enter some details about your deposit. The calculation of compound interest can involve complicated formulas.

To configure the function we need to provide a rate the number of periods the periodic payment the. Compound Interest Calculator Formula. According to Figure 1 this means that type0 the default for the FV functionIf I wanted to deposit 1000 at the beginning of each year for 5 years the FV function in Excel allows me to calculate the result as FV45-10001 where type1Just remember that.

Finds the Future Value where. This calculator uses the compound interest formula to find principal plus interest. Range of interest rates above and below the rate set above that you desire to see results for.

Its better understood in comparison with the concept of simple interest. So compounding is Interest on interest. Compound interest is calculated using the compound interest formula.

N Number of Periods. After a year your money will grow from 1000 to 1030Your initial deposit earned 30 as interest. FV Future Value PV Present Value r Interest Rate as a decimal value and.

A Accrued amount. Compound interest is when a bank pays interest on both the principal the original amount of moneyand the interest an account has already earned. How to calculate compound interest.

The amount after n years A n is equal to the initial amount A 0 times one plus the annual interest rate r divided by the number of compounding periods in a year m raised to the power of m times n. And by rearranging that formula see Compound Interest Formula Derivation we can find any value when we know the other three. Your principal investment amount 2.

For example if you invest 100 and earn 1 annually compounding daily youd earn 00274 daily 1 365 in interest. Compound interest is the addition of interest to the principal sum of a loan or deposit or in other words interest on principal plus interest. In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result.

Compound interest is a great thing when you are earning it. The detailed explanation of the arguments can be found in the Excel FV function tutorial. In the formula A represents the final amount in the account after t years compounded n times at interest rate r.

To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. Monthly Compound Interest Principal. Initial Deposit This is the starting amount of money you plan to deposit into savings.

Compound Interest Formula Steps to Calculate Compound Interest. This will be the base amount the compound interest is calculated on. The formula is given as.

Compound interest is when youre able to reinvest the interest instead of paying it out. FV PV 1r n. Note These formulas assume that the deposits payments are made at the end of each compound period.

The general formula for simple interest is. Subtract the initial balance if you want to know the total interest earned. When we say that the investment will be compounded annually we will earn interest on the.

If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. Compound interest is an interest of interest to the principal sum of a loan or deposit. These are used especially in banks capital markets and stock markets to estimate growth rates.

Assume that you own a 1000 6 savings bond issued by the US Treasury. Daily Compound Interest Formula. A P1 rn nt.

To calculate compound interest you first need to know. The Compound Interest Formula. Daily Compound Interest Formula Calculator.

It is the result of reinvesting interest or adding it to the loaned capital rather than paying it out or requiring payment from borrower so that interest in the next period is then earned on the principal sum plus previously accumulated interest. These are explained below. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

Interest paid in year 1 would be 60 1000 multiplied by 6 60. The compound interest is different from the simple interest. A t A 0 1 r n.

Compound Interest Formula And Compound Interest Financial Quotes Formula

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Exponential Business Major

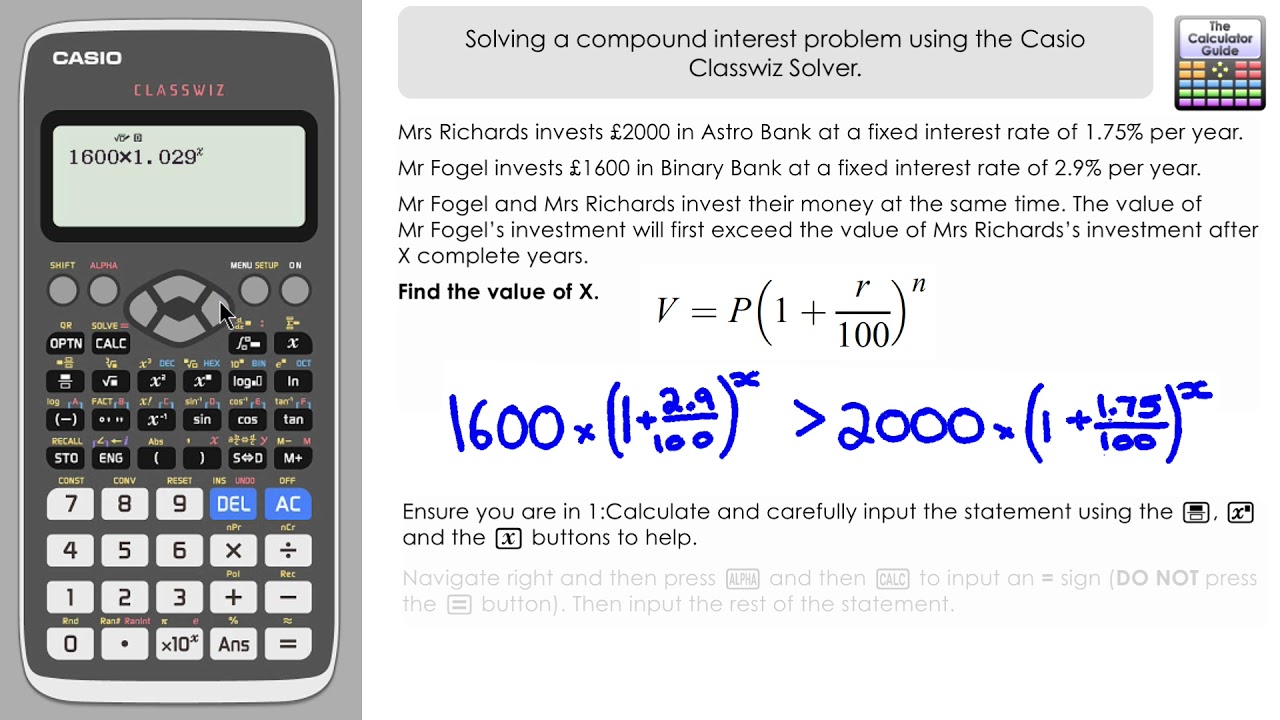

Compound Interest Problem Solving On Casio Classwiz Calculator Fx 991ex Calculator Problem Solving Solving

How To Find Compound Interest How To Calculate Compound Interest Using Formula Youtube Math Videos Compound Interest Compounds

How To Calculate Compound Interest Derivation And Example With Solutions Compound Interest Calculator Understanding

How To Calculate Compound Interest Nta Net Set Exam Pyq Important Question 2020 2021 Exam Compound Interest Development

Formula For How To Calculate Compound Interest Interest Calculator Compound Interest Math Formulas

Interest Calculator Simple Vs Compound Interest Calculator Interest Calculator Financial Tips Financial

How To Solve Compound Interest Formulas Compound Interest Math Math Lessons Financial Education

Compound Interest Calculating Tool Compound Interest Interest Calculator Compounds

Effective Interest Rate Formula Interest Rates Accounting And Finance Rate

Calculating Simple And Compound Interest Compound Interest Simple Interest Pemdas

Compound Interest Formulas Calculator Interest Calculator Compound Interest Compound Interest Math

How To Calculate Interest Compounding For Exponential Growth Accounting Principles Money Quotes Business Savvy

Compound Interest Formula Explained Compound Interest Compound Interest Investments Math Methods

How To Solve Compound Interest Problems College Algebra Tips Algebra Help College Algebra Algebra

How To Calculate Periodic Interest Rate In Excel 4 Ways Exceldemy